Renters Insurance in and around COLUMBUS

Looking for renters insurance in COLUMBUS?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Columbus

- Phenix City

- Midland

- Smiths Station

- Ellerslie

- Cataula

- Hamilton

- Fort Mitchell

- Fort Moore

- Fortson

- Lagrange

- Opelika

- Waverly Hall

- Pine Mountain

- Shiloh

- Lumpkin

- Buena Vista

- Ladonia

- Crawford

Insure What You Own While You Lease A Home

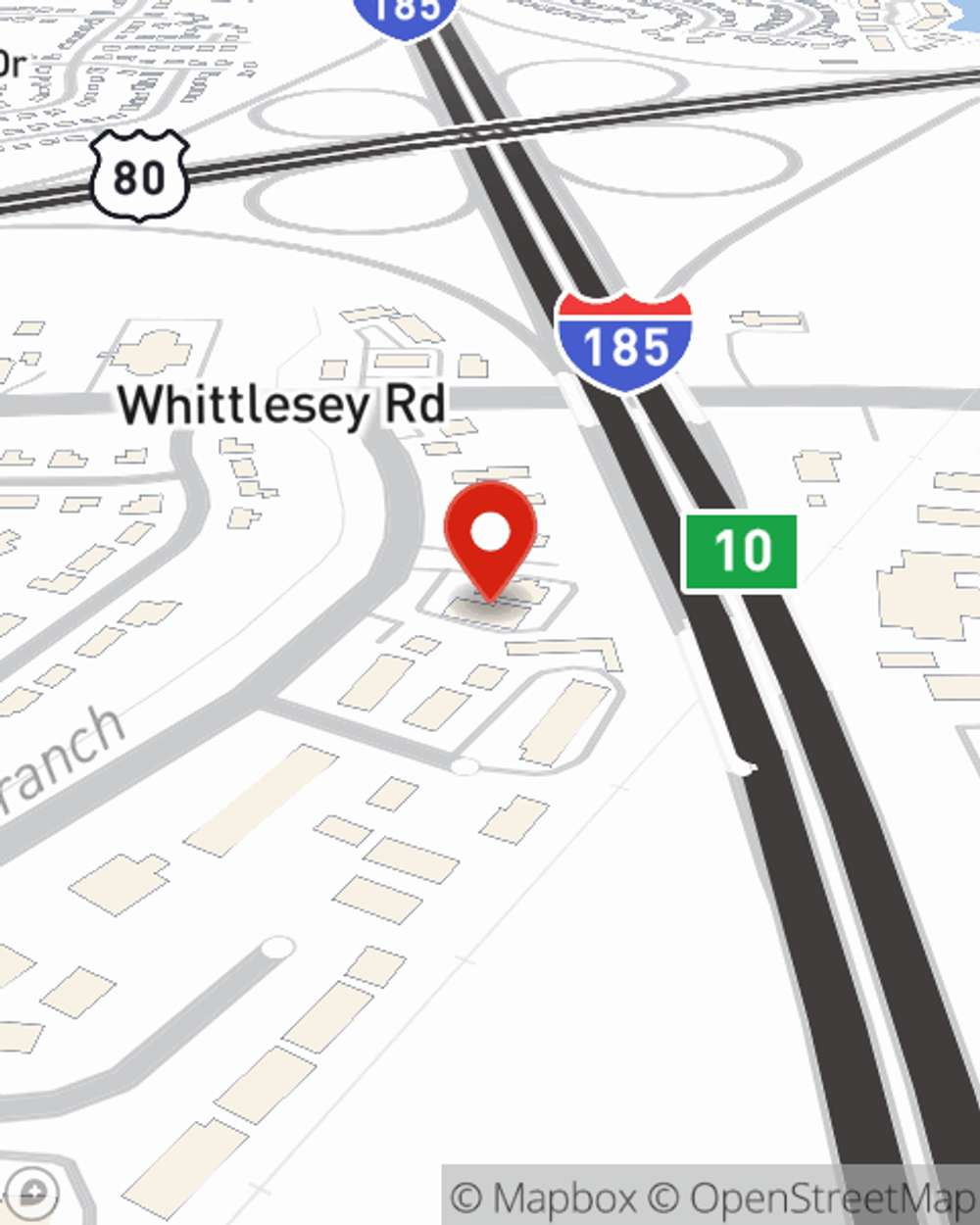

There are plenty of choices for renters insurance in COLUMBUS. Sorting through providers and deductibles to pick the right one can be overwhelming. But if you want reasonably priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy remarkable value and straightforward service by working with State Farm Agent Jay Gemes. That’s because Jay Gemes can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including swing sets, mementos, sound equipment, pictures, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Jay Gemes can be there to help whenever mishaps occur, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Looking for renters insurance in COLUMBUS?

Renters insurance can help protect your belongings

Why Renters In Columbus Choose State Farm

Renters insurance may seem like the least of your concerns, and you're wondering if you really need it. But take a moment to think about what would happen if you had to replace all the possessions in your rented townhome. State Farm's Renters insurance can help when windstorms or tornadoes damage your possessions.

State Farm is a value-driven provider of renters insurance in your neighborhood, COLUMBUS. Contact agent Jay Gemes today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call Jay at (706) 322-8536 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.